In today’s world, our phones constantly demand attention, making it tempting to answer every call or message. However, not all calls are harmless—many are carefully designed traps. Scammers rely on urgency, curiosity, and confusion to manipulate people. Recognizing their tactics is the first step in protecting yourself and avoiding costly mistakes.

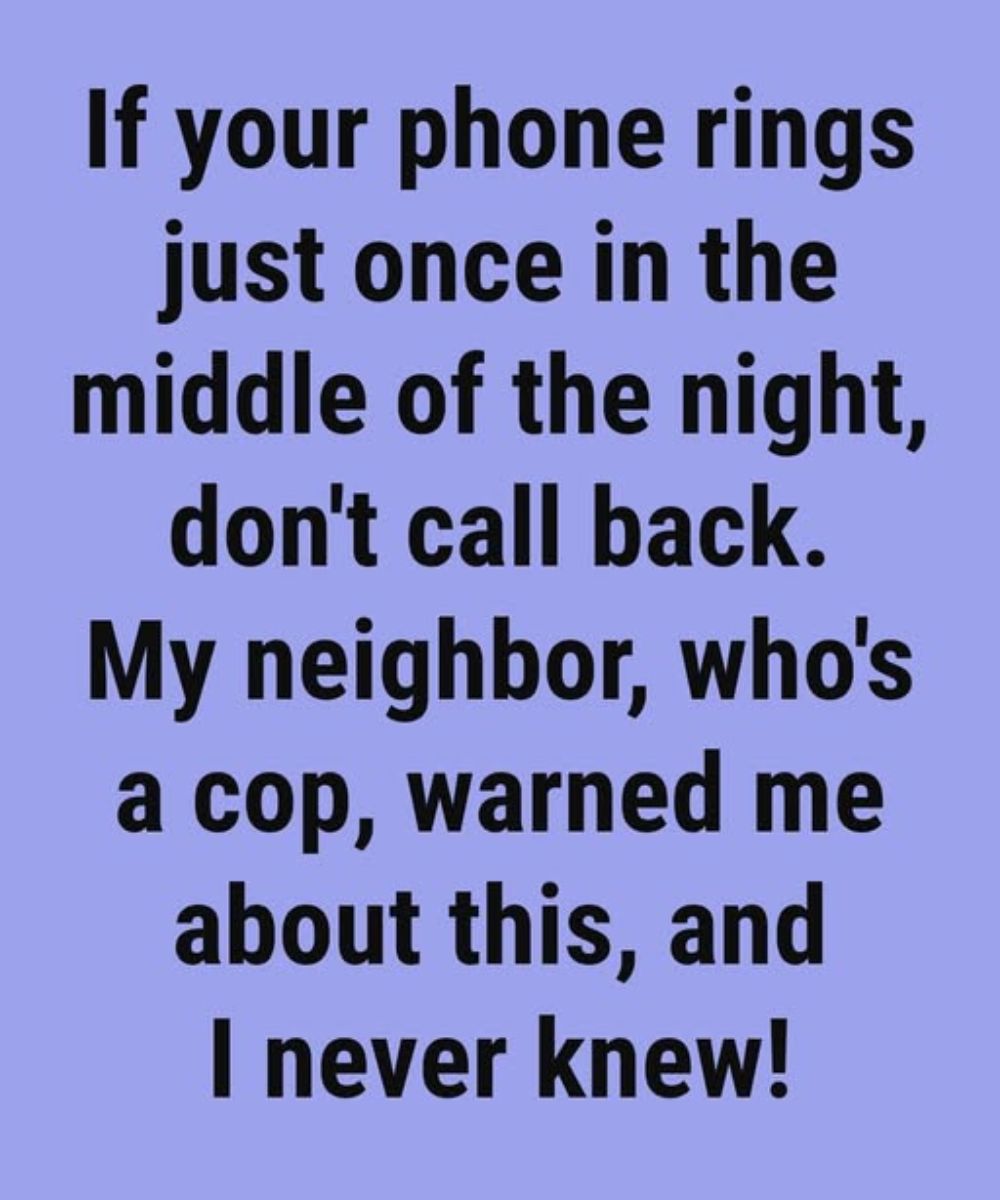

A missed call or unfamiliar number can spark curiosity, which scammers exploit. Calling back can trigger high international fees, reveal personal information, confirm your number for future targeting, or even record your voice for fraudulent use. With caller ID spoofing, scammers can imitate businesses, government agencies, or local numbers, making caution more important than ever. One of the simplest defenses is to pause before responding and verify the number through official websites, customer-service lines, or trusted apps.

Answering a suspicious call doesn’t automatically lead to disaster, but taking action afterward is crucial. Monitor your financial accounts, set up alerts for unusual activity, use strong passwords, and enable two-factor authentication. These measures make it far harder for anyone to misuse your information and give you time to respond if something goes wrong.

If you notice strange charges, unusual voicemails, or a surge of unknown calls, contact your phone carrier or bank immediately. Carriers can block numbers and filter suspicious traffic, while banks can investigate or freeze accounts to prevent further issues. Being cautious with unknown calls, suspicious texts, or unusual voicemails isn’t rude—it’s smart self-protection that safeguards your privacy, finances, and peace of mind.